Media Review

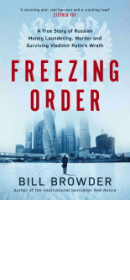

Bill Browder’s Freezing Order reveals how he took on Putin

Proved right about Moscow’s threat, the campaigner reflects on the chances of Vladimir Putin’s downfall, why Britain needs anti-corruption reforms, and why he usually dislikes wealthy peope

Freezing Order by Bill Browder review: jaw-dropping exposé by Putin’s anti-corruption nemesis

The financier’s sequel to his 2015 hit Red Notice reveals the gangster realities of the Russian state – and Putin’s attempts to silence him

Freezing Order by Bill Browder review — my life as Putin’s nemesis

Jamie Susskind is gripped by this thriller-like account of taking on the Kremlin and its corrupt cronies

Bill Browder — hedge-fund manager, “five-foot-nine”, “middle-aged”, “bald” and bespectacled — is not an obvious leading man. Yet his latest book, Freezing Order, is a Hollywood popcorn thriller disguised as a memoir.